I was part of a development program where they ask you to choose between Growth and Impact.

When I think about personal finance in the same context, I see that the same choice exists here too.

The way we treat and use our personal finance is often very random. We just earn money, spend money and then save and invest whatever we can.

Sometimes, it is a little better in terms of saving and investing more, and focusing on generating good returns.

Now that could be a growth objective.

However I have seen there is another good aspect of investing, and that is called the Impact.

What is Impact Investing?

When we invest at a younger age, we tend to think about high returns and growth.

But as we grow old, the real meaning of Investing broadens along with the importance of personal finance.

Then you start thinking about each investment decision as to what impact it will make in your and others’ lives.

Here are a few points to think about:

- A rental property not only appreciates and puts money in your pocket, but also gives someone a place to live.

- A stock investment is not only a ticker symbol, but you are an owner of that company which is impacting the world, hopefully in a positive way.

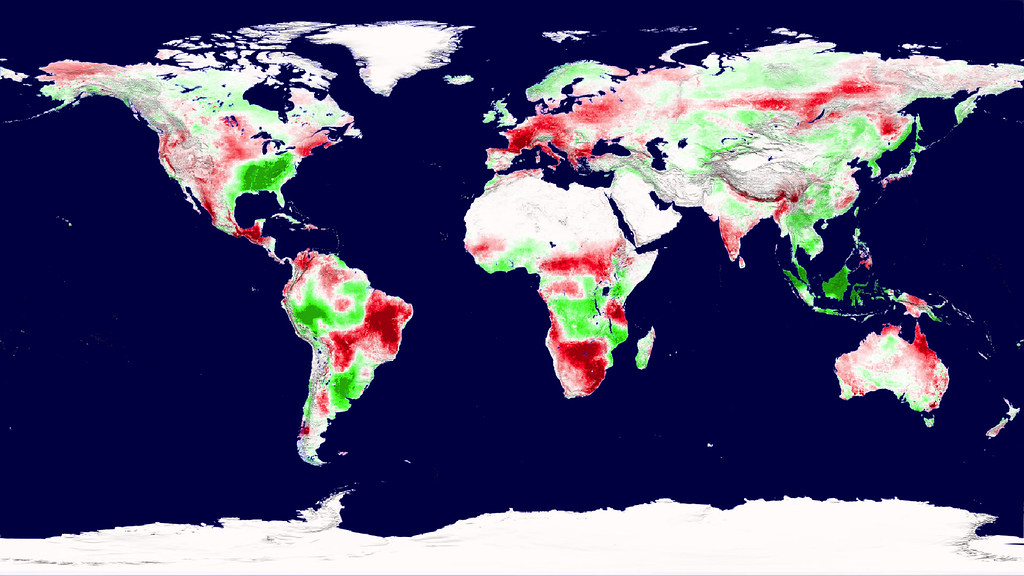

- ESG investing is a new term, where investors are preferring companies which are environmentally, socially and governance wise correct.

- When you loan your money to someone, you get paid the interest but at the same time, you will be seeing the need for that person. It could be helping someone start their business, buy a property or handling an emergency.

Does it mean you have to sacrifice growth?

Absolutely not. You can still have growth components in your portfolio. For example, I have the following which I think purely as growth.

- S&P Index Fund

- International Index Fund

- Emerging Index Fund

- Cryptocurrency

Index Funds are a bit tricky, they own stocks of good companies which have an impact on the world. However when I am buying as an index, I tend to look at it as getting the market returns. So my focus here is the growth.

Balance between Impact and Growth

I always like to keep a balance for everything in life. More so in investing, and so I choose some investments which kind of falls in between Impact and Growth. These are:

- Real Estate Funds or REITs – These are holders of commercial properties and while there is an impact to the world, it is difficult to quantify like a rental property or a business.

- Gold and Silver or any other commodities – These can grow in different times and do not have much quantifiable impact.

- Bank CDs – There is not much growth given that these are very safe investments. At the same time, there is no way to directly feel the impact since it is not transparent what the bank does with the money at the backend.

- Investing in self – This one is tricky, it can be called Growth as well as Impact. That is why I think this is a balance between the two in steroids. If done correctly and consistently, it can generate huge rewards and impact to the world.

Conclusion

In this blog, we have discussed how you can think of your financial decisions, especially investing.

Growth, Impact and Balance are the 3 options that you can consider while making large and small financial decisions.