We have heard about greatness in several areas of life, be it work, family, sports and business.

But Financial Greatness? It is hardly popular and sometimes wrongly associated with earning a lot of money. Some people will confuse it with real estate millionaires or billionaire businessmen.

But how can an ordinary person like you and me be financially great?

We attach too much importance to having lots of money.

What we really need is a way to achieve our goals and live a life without money worries.

Let us first see what are the typical signs if you are not financially great.

- You are wondering at the end of the month where your money went.

- You are waiting for next month’s paycheck to pay off the bills or credit card.

- You have a nagging feeling that you need to save more.

- In a bad economy, you do not have enough to sustain if the paycheck reduces.

- You have credit card debt and/or personal loans that you are not able to fully pay off this month.

- Your definition of affording a purchase is you only need to afford the monthly payment.

- You do not want to think about the bigger goals like your kids’ education.

- You are not even thinking of far ahead goals like retirement.

- You either do not know what a net worth is or your net worth is something you are not proud of.

On the other hand, if you are great with personal finances, you will have several of the below traits.

- You plan where your money should go every month.

- You can pay off your bills and credit card from this month’s paycheck. You had set aside that money.

- You are debt free except your mortgage.

- You have emergency fund saved up for : Job loss, Home repairs, Medical deductibles, Car repairs.

- You are consistently saving for bigger goals : Kids’ education, Retirement, next car, next vacation, next home.

- Your net worth is growing and you are motivated to track it and find ways to grow it.

For a moment, just pause and think! Do you check the box for most of the situations above? Or do you have less than a great situation with not meeting your goals?

So how can this transformation happen? There are essentially 4 steps in a method I call MPEG.

Yes, it is like the video format MPEG, except that this is the movie of your own financial transformation.

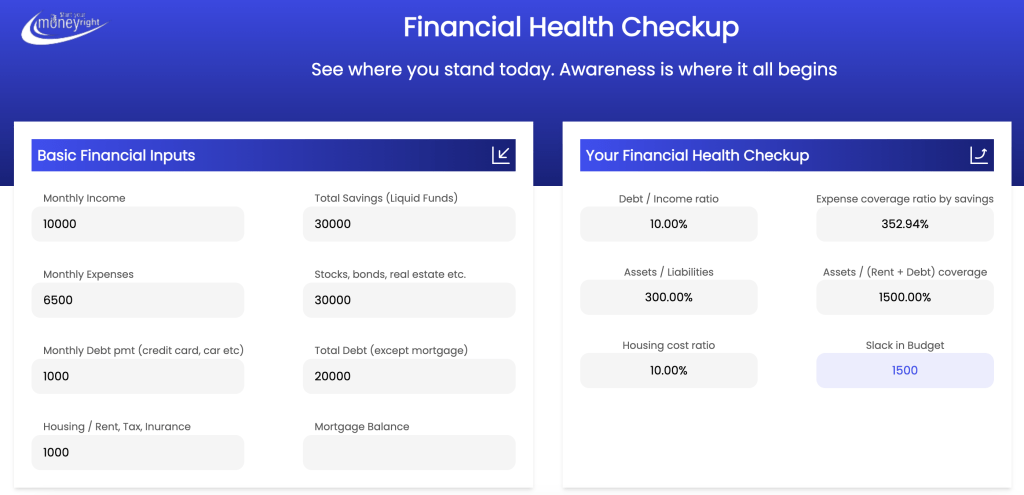

The screenshots are from a Financial Planning tool we are working on.

1. Metrics – Use financial Metrics to see where you are today

Financial metrics are simple ratios that can be calculated with some basic financial inputs.

Below is a snapshot showing the financial health of a person, who is financially great (all checked).

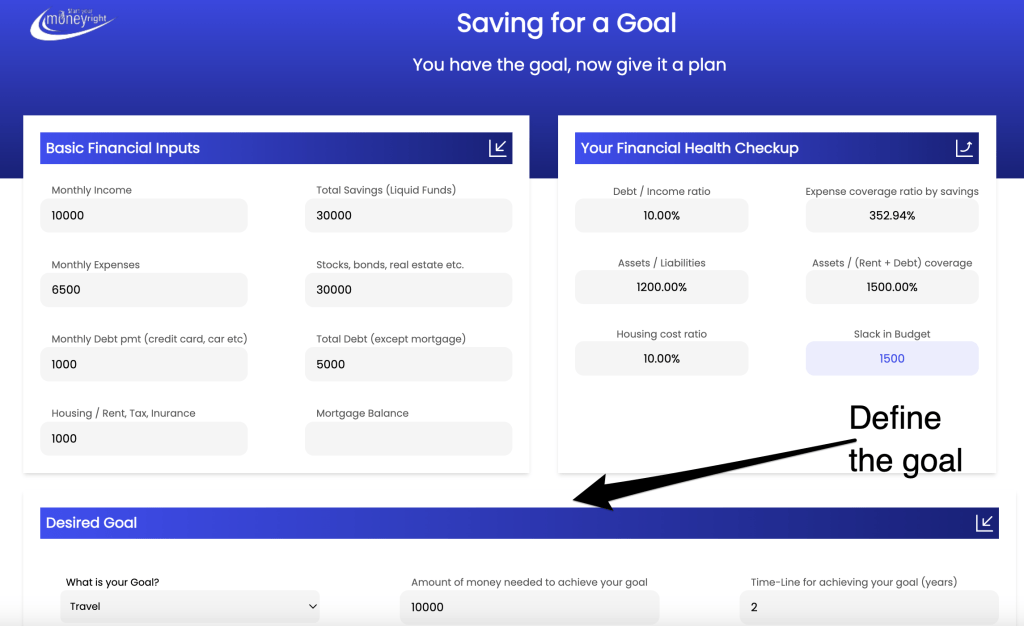

2. Plan – Define your goals clearly

Money is a tool to achieve your financial goals, and not just a number or something to be hoarded.

Start by writing down your goals clearly and what they mean in terms of financial inputs.

For example,

- If you have to save money for a vacation, how much money and by what timeframe?

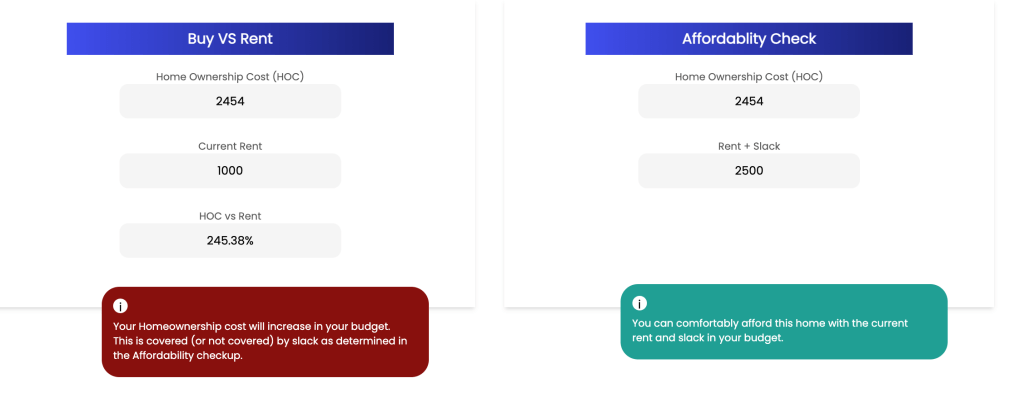

- If you are considering buying a home, what is the home price, taxes and insurance?

3. Execute – Do the steps to achieve the goals

The goals can be analyzed in a S.M.A.R.T format and prioritized over a period using the budget slack and any extra savings. .

S.M.A.R.T –

- Specific (Define the goal as in last section)

- Measurable (supported by hard numbers)

- Achievable (Financial metrics help in this)

- Realistic (can be calculated from slack and extra savings)

- Time bound(defined in last section or now)

Then from the financial metrics and the goal definition, a realistic execution plan is generated.

The tool also provides red flags and comfortable situations as the case may be.

4. Grow – Develop a Growth mindset

Once you are clear about your financial metrics and a plan for your goals, what next?

Well, when you can measure your progress so accurately and have a clear plan for your goals, you are in a growth mindset and on a path to Financial greatness.

You will be able to dream bigger from here.

This is what we at Start Your Money Right strive for, to put every Young Professional in a Financial Growth path.

To be released soon. Copyright 2023 Start Your Money Right.