Previously, I wrote a blog on the IDEA of personal finance.

IDEA is a simple concept to understand the components of personal finance.

It stands for Income, Debt, Expense and Asset.

In the subsequent blogs, I talked about Financial Freedom (FIRE to FINE) and wealth building.

How does the IDEA fit into the Financial Freedom concept?

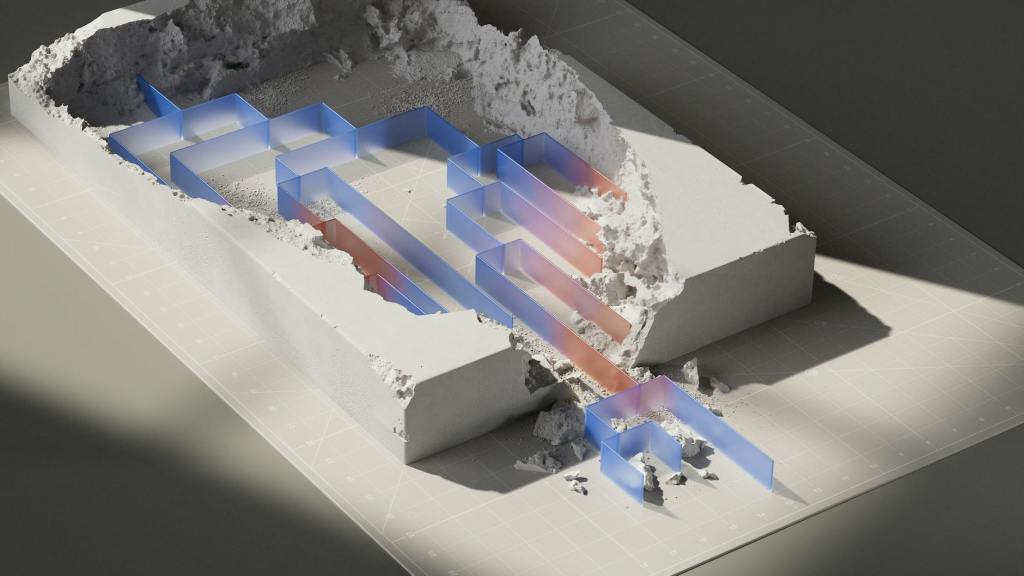

IDEA is the flow of money in the accumulation years

When you are working, living, paying a mortgage or debt, saving a little, you are essentially living the IDEA of money flow. How?

Money flows in your life in the following order, month after month, year after year.

- Income – you get a paycheck for whatever you do with your time.

- Debt – you make the debt payments such as rent, mortgage and other loans.

- Expense – you spend money for your lifestyle, things that matter the most to you.

- Asset – you are left with some money (hopefully!) that you can now save and invest.

So from your income, you take out the debt and living costs and you are left with money for your future.

How do you invest the money for the future?

There are 3 ways and all of them can be described by the IDEA.

The safety part of your financial portfolio

I – Income from CDs and safe bonds

D – You are profiting from debt (loaning your money)

E – You pay some expense in terms of fees, early withdrawal penalty etc.

A – Assurance of getting back your money when needed

The idea here is for the Assurance (A) that you will have money.

When you loan (D) out the money, you are the first lien.

So if the business or bank winds down, debt and bond holders are the first ones to be paid. In case of a bank in the US, you have the FDIC guarantee of up to $250,000.

The Income or Interest (I) is secondary here, but in a high interest rate environment it is not negligible.

The growth part of your portfolio

Growth part of your portfolio is the ownership assets – stocks, corporate bonds.

A is the ownership asset. The stock units, the ownership share, the real estate property, the bond share.

E is the expense ratio of a mutual fund or brokerage firm commission that you pay.

Many people think the stock market is a gamble. The best way to think about it is that you are participating (through investing your money) in the development of the economy or the development of the future.

Thus D stands for development here. When you invest in the stock of Apple or Google, you are buying a share of the technology development these giants are known for.

You invest for the long term, letting the money compound and grow.

In the process, you beat Inflation (I) which is the monster that eats away your purchasing power.

So to summarize, the IDEA for growth investments is –

I – purpose of beating Inflation

D – taking part in the Development

E – Expenses for letting others manage your money or ownership stake

A – Asset that you own in whole or fractional (a share), in a portfolio

The income part of your portfolio

Here is where it gets really interesting and fuels your financial freedom.

Financial Freedom means you have passive income that covers all or part of your expenses.

How does the IDEA help? When you put the IDEA in reverse, your assets generate income. This is also called investment income, portfolio income or passive income.

A – income generating assets like dividend stocks or real estate.

D – some asset like real estate is leveraged and so you service the debt.

E – there are always some operational expenses like taxes and fees.

I – the income left over or distributed to your account.

Once you build these assets enough, you can earn money in your sleep.

Conclusion – the IDEA of Financial Freedom

The final form of financial freedom is when you are no longer working, or have to work.

Your assets and investments are generating enough income to cover your expenses.

That is when the money flows in the opposite direction of the IDEA.

A – assets or investments

E – expenses to maintain the assets

D – leveraged debt or depreciation to shield your taxable income

I – income that supports your lifestyle

So if you are in the accumulation years and money is flowing like an IDEA, your goal will be to direct more towards the Assets (A), so you can reverse the flow.

Remember the D (debt) and E (expense) are a major cut from your income, before you can save for your assets. So living below your means and paying down debt, are the keys to building the asset portfolio.

Later in life, this asset (A) portfolio with low cost (E) and less leverage (D) will generate more passive income (I) for you.

The goal of the wealth building journey is thus to reverse the flow from IDEA to AEDI.