What is Financial Goal setting and how is it different?

Some people like to go with the flow of life, while others like to define life in the way they want. The first category lets life happen to them, the second one makes life happen.

If you are the in the second category, then this post is for you.

Don’t think about your finances first. Define your ideal life and what goals will get you there.

See it is as an A-B transformation, you are at Point A and you want to go to Point B.

Now what are Financial Goals? Financial Goals are simply a plan to use your money to reach the Point B.

Are Financial Goals really different than Life Goals?

In some cases, yes while in some others, no. For example:

- If you are dating your dream partner, money will come into the picture much later.

- If you are learning a new skill, your discipline and hard work will matter more than money.

- If you are planning for higher education, then money does play a role.

- If you are planning to travel the world, you will need money.

- If you want a home of your own, you need a financial goal.

What are the typical goals to set?

Financial goals can be in many different forms.

- Buying an asset or need like a home or a car.

- Provide security and peace of mind like an emergency fund

- Solve a pain point like paying off debt

- To be able to do a pleasurable activitiy, like travel

- Design a better life for tomorrow

These goals may seem mundane or cliche, but most people struggle with one or more of these. Statistics says most people in America cannot come up with a $1000 in an emergency.

We all live for these goals in life but most of us do not plan our finances to achieve them.

What are the variables and how to determine if my goals are realistic?

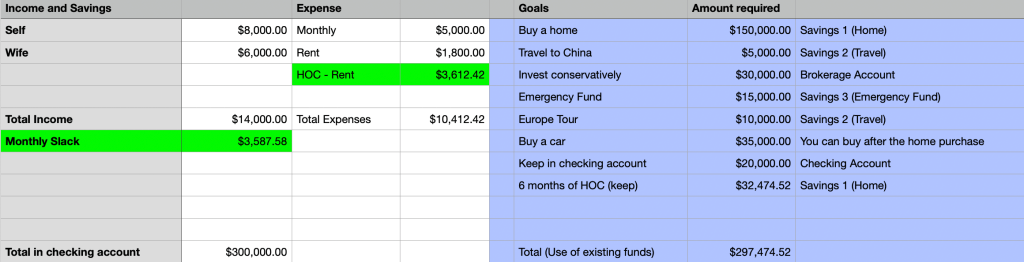

For defining a Financial Goal and the plan to reach it, we have to take a holistic view of our finances. Just allocating whatever money you have to travel or buy a home, may turn out to be a disaster later when the same cash is required for other goals.

As we have discussed in Financial Reboot blog post below, we have to start with the overall financial picture in mind.

Once our finances are properly understood, the variables of Financial Goal setting can be derived.

For example:

- If you have lots of debt, the variable will be the amount of debt to be paid off.

- If you do not have any money left over at the end of the month, the variable is the income or the expenses.

- If you have savings at the end of the month, that becomes a variable for goal setting.

- How much do you need to retire or fund your dream life? Another variable.

These variables play an important role in setting a realistic Financial Goal.

How many goals should I plan for?

Too many goals and we are likely not to achieve any of them.

I think at any point in time, you should have maximum:

- Goal to solve one (the biggest) pain point in your finances

- 3 Goals to design a better life

An example of this could be:

- Pay off all consumer debt (credit cards, personal loan) and improve credit score

- Buy the first home

- Save for a vacation in 2 years

- Save and invest for the future

What is the outcome of the Goal setting stage?

The outcome of the goal setting stage is a clear plan of allocating present and future money to our goals as defined in the previous step.

Conclusion

In this post, we have defined how to think about Financial Goal setting.

Life and Finances are just journeys. Enjoy the transformation through setting goals.

If you would like to discuss your financial goal setting, reach out to me:

info@startyourfinancesright.com