The baby steps of Dave Ramsey have helped millions of people get out of debt, build their wealth and live a life of Financial Peace. That is why the course is called the Financial Peace University.

Let’s take a look at the seven baby steps in order.

- Save $1000 as your first emergency fund

- Pay off all debt except mortgage

- Build an emergency fund of 3-6 months of expenses

- Start paying off your mortgage

- Start saving for college

- Invest 15% of your income every month for retirement

- Give and build wealth

The steps are very simple, intuitive and in the right order.

Till step 3, it’s sequential. That is, you cannot save for 3-6 months emergency fund without first paying off all non-mortgage debt.

The next 3 can be done in parallel, since each of those will take years and decades.

The last one can be done always, as you work through the baby steps.

Why it always works

When I moved to the US, I started studying the personal finance landscape in the US.

Amidst a lot of financial advice and strategies, Dave’s seven baby steps came across like a gem. Do these in order and you have a clean, simple financial life.

Over the years, I followed the baby steps since it also resonated with how I was managing my finances in India.

I had zero debt and was in step seven:

- I had more than a $1000 – 65000 INR

- I had no debt, both my cars were paid off and I used debit cards

- I had more than 6 months of expenses in cash and FD (equivalent to CD)

- I had paid off two mortgages, bought my homes with cash mostly

- I was saving for a college in a mutual fund portfolio

- I was saving for retirement in a workplace plan and a mutual fund portfolio

- I was giving, although this was more random

These baby steps when I followed in the US gave me a solid foundation of my finances.

From time to time, I stray away from it but then it reminds me the importance of financial discipline. In my current state, when I look at the finances I know exactly where I need to fix things. For example, last year I bought a car on financing. My main goal is now to pay off that debt by end of this year.

It is really Financial Peace in action. If you have not, try it out.

What are the challenges of Ramsey’s baby steps implementation?

Now any strategy is as good as its implementation.

What are the challenges in implementing Ramsey’s baby steps?

- The $1000 emergency fund is not enough. So while you are on step two paying off debt aggressively, any emergency with > $1000 will put you back into debt.

- The debt payoff does have a clear goal of going to zero, and Dave suggests the snowball method. But there are no clear goals or priorities for the other things in life like vacation, buying a home, pay off mortgage vs. invest, college vs. retirement etc.

- The baby steps does not say how to find the money for all the steps. Dave suggests using a written budget but then sells his EveryDollar app. There is no mention of how to create a budget. 70% of people cannot stick to a budget more than 3 months.

- Finally, there is no credible advice of how to grow the retirement savings. His solution is to put into 401k and invest into four types of mutual funds. While this may work for some people, a lot of financial experts have questioned his vague statements of 12% return per year.

Last but not the least, it is very difficult to believe that the same steps will apply to everyone regardless of their age, financial condition, aspirations and goals.

- If a 50 year old is behind on retirement savings, he will prioritize saving more than 15% over paying off a mortgage.

- A young person who has decades to retirement may do better by investing aggressively than paying off mortgage.

- A $1000 emergency fund is not enough for most people, but a good start to break a paycheck to paycheck cycle. `

- Even a 3-6 months emergency fund varies. Some people may need 12 months of expenses saved up due to the volatile nature of their jobs and the current economy.

So with that background, I will introduce my 4 steps which are more flexible and customizable.

The 4 steps to Financial abundance

It is important to understand your finances with respect to your own constraints and situation.

We will look at the 4 steps each of which responds and can be tailored to unique needs.

In fact, the 4 steps are not simply recommendations but a framework under which to design your financial growth.

Financial Reboot

The first step is to understand where you stand financially. For this, the $1000 is not enough. You have to understand whether you have enough savings, what is your debt tolerance vs. risk and how much below your means you are operating.

All of these can be measured with the 8 numbers.

Monthly numbers

- Net Income

- Net Expenses

- Debt Payment

- Housing Payment

Snapshot numbers

- Total savings

- Total investments

- Total debt outstanding

- APR of debts

With these 8 numbers, you can calculate various things about the finances.

- Whether you are living below your means or not?

- How many months of expenses can your savings cover?

- How much investments do you already have compared to your debt?

- How costly is your debt?

Of course, this is not a recommendation like save $1000, pay off all debt but it is for people who want to get a proper handle to their financial situation.

A more detailed discussion on Financial Reboot is here.

Financial Goal or Plan

Once you understand your finances, what are you going to do about it?

- What problems do you want to solve?

- What goals do you want to achieve?

- How much money do you need for a college?

- How much money do you need to save up for a home?

Once you craft your goals to reasonable degree of specificity and realism, you can then setup a SMART financial goal tracking system.

The following blog describes the SMART system of setting financial goals.

Financial Flow

The next step of financial goal planning is to set up an execution flow.

Ramsey’s steps do not mention anything about how to budget, what portion to save up for the goals etc. Paying off debt is a good goal, but most people do not know how to create a budget and how to use a sustainable budget that they can follow for years.

There are several ways to budget, but the most effective in this framework is the tree budget. I have used this system for years and love the simplicity.

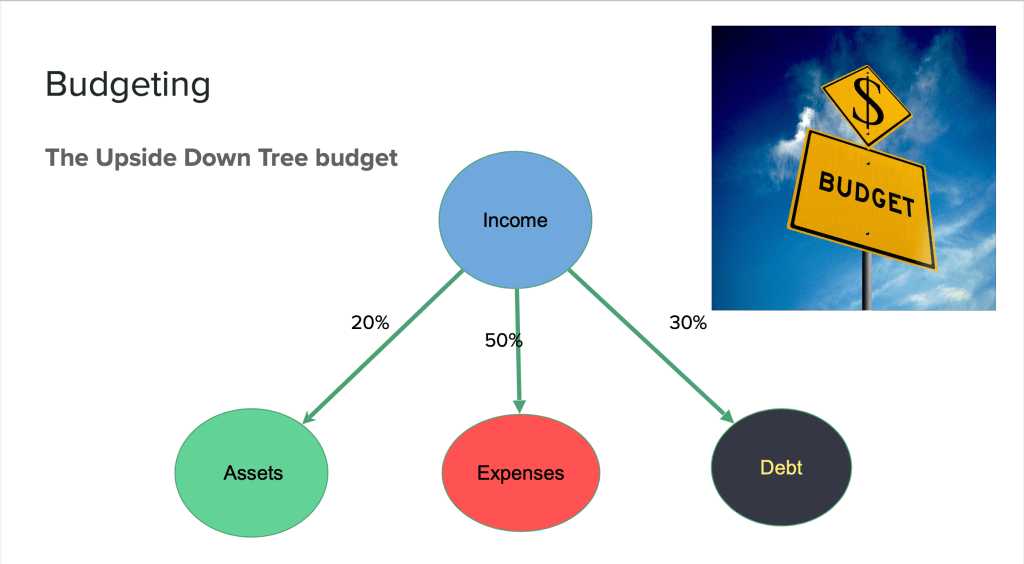

The IDEA is very simple. Break your Income into 3 parts – Debt, Expense and Assets.

- Some of your debt payment goals will come from allocating more money to the Debt (D).

- Some of the aspirational goals will come from allocating more money to the Assets (A).

- The last part is the Expense (E), which is taken out after D and A are set aside or paid for.

Do you see the simplicity and ease of implementing this?

- Your income hits your checking account – let’s call it I.

- You pay bills and debt payments (D) from the same account.

- You move the budgeted expenses to another account E.

- You set aside money for your goals into an account A.

Thus with two checking and one savings account, you can implement an automatic money system that does not require tedious budgeting.

Here is a previous blog which talks about this macro budget.

Financial Growth

Now that you have setup your system to track your finances, pay off debt, save for goals and an automated budget, you will be much more motivated to invest and grow your financial situation.

This is why Financial Growth is the last step of the process.

Unless you build a solid foundation and defined your goals clearly, randomly investing 15% of paycheck may not be enough for most people.

The investment bucket is unique to each one of your goals, be it retirement, saving for college or saving for financial freedom.

Each goal will have different risk tolerance and growth expectations, hence different portfolios.

- If a short term goal, the portfolio will mainly consist of cash and CD.

- If a medium term goal, the portfolio will be in mutual funds with debt/equity mix.

- If a long term goal like retirement, it will be growth mutual funds and real estate.

Just investing in a 401k without the actual goals may not be the right strategy.

Conclusion

Every financial framework or baby step process helps you to develop good habits in personal finance. It is so essential, that without the discipline of living below your means and saving money, there is no system that will work.

So Ramsey’s system does give a solid foundation and can be seen as orthogonal to the 4 step process described here. You have to choose what suits your case better, and maybe once you setup the foundation (check all the boxes) with Ramsey’s baby steps, you can develop a better financial roadmap with the 4 steps.